Income Tax Return in ITR-1 for Assessment Year AY 2019-20 or Financial Year FY 2018-19 is now available for filing online on income tax e-filing website. ITR-1 which is also known as 'Sahaj' (easy) but is not so easy now to file. However, with some basic understandings, one can file Income Tax Return in ITR-1 independently. In this article, the endeavor is to provide a step-by-step guide to file ITR-1 for AY 2019-20 independently without the help of any consultant or expert. Do remember any mistake or error committed in the filing of ITR-1 may invite tax notices in the future.

Though filing of Income Tax Return in ITR-1 is easy and simple it remains so only in interface unless one understands the basic concepts of return filing and how the data are required to be reported.

Step 1: Selection of appropriate ITR form -

One of the pre-requisite of filing of return is the selection of appropriate ITR forms applicable to the taxpayer's case. Every year the income-tax department notifies different ITR forms for different categories of taxpayers. For the current assessment year 2019-20 which covers the income period 2018-19 the following ITR forms were notified vide Notification No. 32/2019 dated 01.04.2019-

ITR Form No.

|

Description

|

ITR 1

|

For

Individuals being a Resident (other than Not Ordinarily Resident) having

Total Income upto Rs.50 lakhs, having Income from Salaries, One House

Property, Other Sources (Interest etc.), and Agricultural Income upto Rs.5

thousand(Not for an Individual who is either Director in a company or has

invested in Unlisted Equity Shares)

|

ITR 2

|

For Individuals and HUFs not

having income from profits and gains of business or profession

|

ITR 3

|

For individuals and HUFs

having income from profits and gains of business or profession

|

ITR 4

|

For Individuals, HUFs and

Firms (other than LLP) being a Resident having Total Income upto Rs.50 lakhs

and having income from Business and Profession which is computed under

sections 44AD, 44ADA or 44AE

(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares) |

ITR 5

|

For persons other than:-

(i) Individual, (ii) HUF, (iii) Company and (iv) Person filing Form ITR-7 |

ITR 6

|

For Companies

|

ITR 7

|

For persons including

companies required to furnish return under sections 139(4A) or 139(4B) or

139(4C) or 139(4D)

|

One must be careful in selecting the appropriate ITR form. While selecting the ITR form for the current year, the basis on which ITR form selected and filed in the preceding year may not hold good and one may need to change the form this year under different circumstances.

For example, a salaried individual may have filed the return in ITR-1 in the preceding year since he had only income from salary and FD interest income. If there is no change in the heads of income, he may choose to file ITR-1 for the current year. However, though there is no change in the nature of income for the same individual, but if he is a director of any company or held any equity shares of an unlisted company during the previous year, then for the current assessment year 2019-20, he has to file ITR-2 and not ITR-1 even though his source of income remains the same. This is because the restrictions on the use of ITR-1 by individuals were widened this year as compared to the preceding year.

Similarly, in another case, if he has earned income from the sale of shares apart from salary income and FD interest income in the current year, then the income will come under the head 'Capital Gains'. Then due to change in heads of income in the current year compared to the preceding year, ITR-2 will be applicable for the current year and not ITR-1.

Though reference may be given to last year return filed but needs to be modified suitably for the current year. One must be aware of the changes in rules for selecting the appropriate ITR forms every year. These rules are not constant but dynamic and change every year.

Read Also:

10 changes in ITR 1 filing in 2019

Read Also:

10 changes in ITR 1 filing in 2019

Step 2: Documents required for filing of ITR 1-

Before one starts filing of ITR-1, the following documents must be kept handy for easy and smooth filing of the returns:

(a) Form 16: One of the most famous documents among the salaried persons, Form 16 is a TDS certificate which is issued by the employer every year. Form 16 has two parts - Part A and Part B.

Part A contains the name, address, and PAN of the employee. The employer's name, address, PAN and TAN is also mentioned in this part of Form 16. Besides, Part A reports how much tax was deducted by the employer from the employee during the previous or financial year with the quarter-wise break-up. It also includes the 'Amount Paid' column corresponding to TDS amount. Form 16 for Assessment Year 2019-20 will contain the aggregate amount of tax deducted by the employer during the Financial Year 2018-19. One must match the amount of TDS with the taxpayer's Form 26AS.

Part B of Form 16 contains the computation of Income from salary for the relevant financial year. It shows the break-up of salary received and exemption allowed by the employer while computing the income from salary. The deduction claimed and considered by the employer under section 80C, section 80D, etc. while determining the total income of the employee is also shown in this part. One should verify the same before the filing of ITR-1. If the employer did not consider any deduction or the employee could not or did not disclose the same to the employer, the employee is entitled to claim the same in the ITR-1 if otherwise eligible and possess the evidence.

This year in 2019 many changes were brought into the Form 16 as well as in Form 24Q for reporting of the income of an employee by the employer to the income tax department. The details may be read in this article titled Changes in Form 16 for salary TDS certificate for AY 2019-20.

(b) Details of rental Income: ITR-1 can be filed only if the taxpayer has income from only one house property. If the taxpayer has income from more than one house property, ITR-1 cannot be filed. The 'one' house property may be self-occupied or let-out.

Self-Occupied house property is one which is used by the taxpayer for his own or family members' residence and is not rented out to any tenant.

Let-Out house property is one which is rented out to a tenant for rent and the taxpayer has earned rental income therefrom in the financial year 2018-19.

If a house property was rented in the previous year 2018-19, then the taxpayer is entitled to claim a deduction for payment of municipal taxes of that house property, apart from standard deduction of 30 percent, from the rental income.

For a self-occupied house property, the income is always taken as 'Nil'.

(c) Bank passbook, Interest certificates from banks, etc. - If the taxpayer has earned interest income from banks or other financial institutions, the interest certificates must be obtained to get the amount of interest income for the previous year 2018-19. All the passbooks must be updated to record the transactions till 31st March 2019 including interest credited by the bank on the savings account. this year, the interest on income-tax refund is required to be shown separately in ITR-1. The same may be obtained from the last year's Intimation u/s 143(1). It is the difference between the amount of refund credited to the bank account and the amount of refund claimed in the preceding year(s) ITR. Bank passbook is also required for filling of bank details in ITR-1 for the account number and IFSC code.

(d) Details of investments, etc for claiming deduction under section 80C, section 80D, etc. : If the taxpayer is a salaried employee, the same be found in Form 16. Others may prepare a list of deduction to be claimed under these sections.

(e) Details of exempt income: Many of us fail to report the exempt income in the ITR. The exempt income is required for reporting purpose only and does not add to total income or affect the tax liability of the tax[payers. Interest income from PPF is exempt and many of us do not report the same in the ITR-1.

(f) Other documents: Other documents like PAN card, Aadhaar Card may be kept handy. PAN is required for logging on the income-tax e-filing website or for registration on the website. From this year 2019-20, no ITR-1 can be filed if Aadhaar is not linked to PAN.

After collecting the documents for filing of ITR-1, let us check who is eligible to file income-tax return in ITR-1 for the income year 2018-19 or AY 2019-20.

The provisions related to the procedure for filing of income-tax return and the applicability of ITR forms are contained in Rule 12 of the Income Tax Rules, 1962.

The following rules are contained in Rule 12 for the filing of income-tax return in ITR-1 for AY 2019-20:

In this year 2019, all the assessees or taxpayers are mandatorily required to file their income tax returns online electronically except individuals over the age of 80 years (very senior citizen) who have the option of filing the tax return in paper format as well but only for ITR 1 or ITR 4. If the very senior citizen uses any other form other than ITR 1 or ITR 4, he or she cannot file ITR in paper format.

An Individual cannot file ITR-1 if the following conditions are satisfied if he-

(a) Form 16: One of the most famous documents among the salaried persons, Form 16 is a TDS certificate which is issued by the employer every year. Form 16 has two parts - Part A and Part B.

Part A contains the name, address, and PAN of the employee. The employer's name, address, PAN and TAN is also mentioned in this part of Form 16. Besides, Part A reports how much tax was deducted by the employer from the employee during the previous or financial year with the quarter-wise break-up. It also includes the 'Amount Paid' column corresponding to TDS amount. Form 16 for Assessment Year 2019-20 will contain the aggregate amount of tax deducted by the employer during the Financial Year 2018-19. One must match the amount of TDS with the taxpayer's Form 26AS.

Part B of Form 16 contains the computation of Income from salary for the relevant financial year. It shows the break-up of salary received and exemption allowed by the employer while computing the income from salary. The deduction claimed and considered by the employer under section 80C, section 80D, etc. while determining the total income of the employee is also shown in this part. One should verify the same before the filing of ITR-1. If the employer did not consider any deduction or the employee could not or did not disclose the same to the employer, the employee is entitled to claim the same in the ITR-1 if otherwise eligible and possess the evidence.

This year in 2019 many changes were brought into the Form 16 as well as in Form 24Q for reporting of the income of an employee by the employer to the income tax department. The details may be read in this article titled Changes in Form 16 for salary TDS certificate for AY 2019-20.

(b) Details of rental Income: ITR-1 can be filed only if the taxpayer has income from only one house property. If the taxpayer has income from more than one house property, ITR-1 cannot be filed. The 'one' house property may be self-occupied or let-out.

Self-Occupied house property is one which is used by the taxpayer for his own or family members' residence and is not rented out to any tenant.

Let-Out house property is one which is rented out to a tenant for rent and the taxpayer has earned rental income therefrom in the financial year 2018-19.

If a house property was rented in the previous year 2018-19, then the taxpayer is entitled to claim a deduction for payment of municipal taxes of that house property, apart from standard deduction of 30 percent, from the rental income.

For a self-occupied house property, the income is always taken as 'Nil'.

(c) Bank passbook, Interest certificates from banks, etc. - If the taxpayer has earned interest income from banks or other financial institutions, the interest certificates must be obtained to get the amount of interest income for the previous year 2018-19. All the passbooks must be updated to record the transactions till 31st March 2019 including interest credited by the bank on the savings account. this year, the interest on income-tax refund is required to be shown separately in ITR-1. The same may be obtained from the last year's Intimation u/s 143(1). It is the difference between the amount of refund credited to the bank account and the amount of refund claimed in the preceding year(s) ITR. Bank passbook is also required for filling of bank details in ITR-1 for the account number and IFSC code.

(d) Details of investments, etc for claiming deduction under section 80C, section 80D, etc. : If the taxpayer is a salaried employee, the same be found in Form 16. Others may prepare a list of deduction to be claimed under these sections.

(e) Details of exempt income: Many of us fail to report the exempt income in the ITR. The exempt income is required for reporting purpose only and does not add to total income or affect the tax liability of the tax[payers. Interest income from PPF is exempt and many of us do not report the same in the ITR-1.

(f) Other documents: Other documents like PAN card, Aadhaar Card may be kept handy. PAN is required for logging on the income-tax e-filing website or for registration on the website. From this year 2019-20, no ITR-1 can be filed if Aadhaar is not linked to PAN.

Step 3: Ascertain the eligibility for filing ITR-1: Who can file ITR-1 and who cannot file ITR-1.

After collecting the documents for filing of ITR-1, let us check who is eligible to file income-tax return in ITR-1 for the income year 2018-19 or AY 2019-20.

The provisions related to the procedure for filing of income-tax return and the applicability of ITR forms are contained in Rule 12 of the Income Tax Rules, 1962.

The following rules are contained in Rule 12 for the filing of income-tax return in ITR-1 for AY 2019-20:

In this year 2019, all the assessees or taxpayers are mandatorily required to file their income tax returns online electronically except individuals over the age of 80 years (very senior citizen) who have the option of filing the tax return in paper format as well but only for ITR 1 or ITR 4. If the very senior citizen uses any other form other than ITR 1 or ITR 4, he or she cannot file ITR in paper format.

ITR 1 can be filed only by an individual under specified circumstances. HUF cannot use ITR 1.

The individual must be a resident. Thus a non-resident cannot file ITR 1.

An individual can file a return of income in ITR 1 only and only if the Total Income of the individual includes the following incomes-

a) Income chargeable under the ‘Salaries’

b) Family Pension Income u/s 57(iia)

c) Income from ONE House Property without any carry forward or brought forward of loss. This means the house property must be a self-occupied house property. If the house property is let-out, the interest paid on the home loan shall not exceed Rs. 2,00,000 during FY 2018-19. If the interest paid on the home loan exceeds Rs. 2,00,000 and the individual assessee wants to carry forward the loss, then such individual shall use ITR-2 and not ITR 1.

d) Income from Other Sources like bank interest, interest on income tax refund, etc. The income from other sources shall not include winnings from lottery or income from race horses.

An Individual cannot file ITR-1 if the following conditions are satisfied if he-

- has any foreign assets including shares and bonds.

- any foreign bank accounts.

- any income from foreign sources.

- any income to be apportioned in accordance with provisions of section 5A i.e. Portuguese Civil Code applies.

- claimed deduction u/s 57, other than deduction claimed u/s 57(iia). Section 57(iia) deals with standard deduction from family pension income.

- is a director of any company, listed or unlisted.

- has held any unlisted equity share at any time during the previous year. It is immaterial whether the shares are in physical form or dematerialized form. This does not cover listed equity shares. Unlisted equity shares are the shares of companies which are not listed and traded on stock exchanges like NSE or BSE.

- is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee.

- has claimed any relief of tax under section 90 or 90A or deduction of tax under section 91.

- has agricultural income, exceeding Rs. 5,000.

- his total income, exceeding Rs. 50 Lakh during FY 2018-19. If the total income exceeds Rs. 50 Lakh then details of Assets and Liabilities are required to be reported. ITR 1 does not have such a schedule.

- has income taxable under section 115BBDA. Section 115BBDA deals with dividend income from domestic company above Rs. 10 lakh.

- has income of nature referred to in section 115BBE which deals with tax on income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69 - all are related to undisclosed income.

In the above circumstances, ITR 1 cannot be filed. If any of the above restrictions apply to an individual, he or she has to use ITR 2 or ITR 3 or any other appropriate form.

Income Tax slab for Individuals for AY 2019-20:

The income tax slab and income tax rates for the Financial Year 2018-19 or Assessment Year 2019-20 for Individual taxpayers are given below-

Table-1

Category of Taxpayer

|

Individual

|

Residential Status

|

Resident and Non-Resident

|

Age of the Taxpayer

|

Under 60 years of age

|

Total Income

|

Income-Tax Rate

|

Up to Rs. 2,50,000

|

Nil

|

Rs. 2,50,001 to Rs. 5,00,000

|

5%

|

Rs. 5,00,001 to Rs. 10,00,000

|

20%

|

Above Rs. 10,00,000

|

30%

|

Table-2

Category of Taxpayer

|

Individual (Senior Citizen)

|

Residential Status

|

Resident

|

Age of the Taxpayer

|

Above 60 years of age

|

Total Income

|

Income-Tax Rate

|

Up to Rs. 3,00,000

|

Nil

|

Rs. 3,00,001 to Rs. 5,00,000

|

5%

|

Rs. 5,00,001 to Rs. 10,00,000

|

20%

|

Above Rs. 10,00,000

|

30%

|

Table-3

Category of Taxpayer

|

Individual (Super Senior Citizen)

|

Residential Status

|

Resident

|

Age of the Taxpayer

|

Above 80 years of age

|

Total Income

|

Income-Tax Rate

|

Up to Rs. 5,00,000

|

Nil

|

Rs. 5,00,001 to Rs. 10,00,000

|

20%

|

Above Rs. 10,00,000

|

30%

|

Important:

| |

Surcharge on Income-tax for Individuals:

|

In all cases covering Table-1/2/3 above

|

Where Total Income is up to Rs. 50,00,000

|

Nil

|

Where Total Income exceeds Rs. 50,00,000

|

10%

|

Where Total Income exceeds Rs. 1,00,00,000

|

15%

|

Health & Education Cess on Income-tax and Surcharge for Individuals:

|

In all cases covering Table-1/2/3 above

|

Health & Education Cess

|

4%

|

Note: Rebate u/s 87A is allowed on tax liability to a resident Individual if Total Income does not exceed Rs. 3,50,000. The maximum amount of rebate is Rs. 2,500. This rebate is not allowed to a non-resident.

|

Marginal Relief on Surcharge

|

Where Total Income exceeds Rs. 50,00,000

|

Total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of Rs. 50,00,000 by more than the amount of income that exceeds Rs. 50,00,000.

|

Where Total Income exceeds Rs. 1,00,00,000

|

Total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax and surcharge on a total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

|

Due Date for filing of Return of Income in ITR-1 for AY 2019-20:

The prescribed due date for filing of income-tax return in ITR-1 is 31st July 2019 for the Financial Year 2018-19 or Assessment Year 2019-20.

A return in ITR-1 for AY 2019-20 can be filed after the due date of 31st July 2019 but before 31st March 2020 with late fees which vary according to 'Total Income' of the taxpayer and belated time of filing the ITR-1 as given below:

Time of filing of

ITR-1

|

Total Income is up to

Rs. 5 Lakh

|

Total Income is more

than Rs. 5 Lakh

|

If

ITR-1 is filed by 31st July

2019

|

Rs. Nil

|

Rs. Nil

|

If

ITR-1 is filed in the period between 01st

August 2019 to 31st December 2019

|

Rs. 1,000

|

Rs. 5,000

|

If

ITR-1 is filed in the period between 01st

January 2020 to 31st March 2020

|

Rs. 1,000

|

Rs. 10,000

|

In the first case where the return of income in ITR-1 is filed within the due date of 31st July, no late fees is payable. However, if the ITR-1 is filed after the due date but before 31st December, then the late fee is Rs. 5,000 if total income exceeds Rs. 5 lakh in the AY 2019-20. If the ITR-1 is filed after 31st December, then the late fee is increased to Rs. 10,000 under similar circumstances. In any case, if the total income does not exceed Rs. 5 lakh then the late fees is limited to Rs. 1,000. Please note that no return of income in ITR-1 can be filed for the AY 2019-20 after 31st March 2020.

Who are mandatorily required to file a return of income in ITR 1?

As per section 139(1) of the Income Tax Act, 1961, if the 'Gross Total Income' of an Individual exceeds the basic exemption limit amount in a previous year then he is compulsorily required to file the income tax return. Basic exemption limit amount is the amount of income on which no tax is payable as per the income-tax slab as mentioned in the Table 1/2/3 above. Thus an Individual below 60 years of age is compulsorily required to file an income tax return if his 'Gross Total Income' in FY 2018-19 exceeds Rs. 2,50,000. Similarly, for a senior citizen and a very senior citizen individual, the limit is Rs. 3,00,000 and Rs. 5,00,000 respectively.

If the 'Gross Total Income' of an individual does not exceed the basic exemption limit, then he is not required to file the income tax return though voluntarily he may file the income tax return.

For an individual filing income tax return in ITR 1, the 'Gross Total Income' is the aggregate of income under the following heads-

In this context, it is important to note that due to rebate allowed under section 87A if no tax is payable, but still the taxpayer has to file the return of income since his 'Gross Total Income' is more than the basic exemption limit. For example, if the income from salary of an individual below 60 years of age is Rs. 3,00,000 then after rebate his tax liability will be 'Nil'. But since his income exceeds the basic exemption limit of Rs. 2,50,000, he is required to file the income tax return. Reducing the tax liability due to rebate does not absolve an individual from the filing of income tax return.

Also Read:

No tax on Income up to Rs. 5 Lakh as per Interim Budget 2019

If the 'Gross Total Income' of an individual does not exceed the basic exemption limit, then he is not required to file the income tax return though voluntarily he may file the income tax return.

For an individual filing income tax return in ITR 1, the 'Gross Total Income' is the aggregate of income under the following heads-

- Income under the head salaries after all exemption under section 10 and 16 (which includes 'Standard Deduction'),

- Income from House Property, and

- Income from other sources.

In this context, it is important to note that due to rebate allowed under section 87A if no tax is payable, but still the taxpayer has to file the return of income since his 'Gross Total Income' is more than the basic exemption limit. For example, if the income from salary of an individual below 60 years of age is Rs. 3,00,000 then after rebate his tax liability will be 'Nil'. But since his income exceeds the basic exemption limit of Rs. 2,50,000, he is required to file the income tax return. Reducing the tax liability due to rebate does not absolve an individual from the filing of income tax return.

Also Read:

No tax on Income up to Rs. 5 Lakh as per Interim Budget 2019

Modes of software for filing of ITR 1:

As stated above it is now mandatory to file the income tax return in online mode only except in case of very senior citizens for ITR-1 and ITR-4 only. No paper format of return or manual return is possible. The income-tax department has provided various software at free of cost for all the ITR forms including ITR-1 on its e-filing website. In the case of software utilities, two versions are also provided. One is Excel-based utility and the other one is Java-based utility. One can use any one of the software version for filing of ITR forms as per taxpayers' convenience after downloading the same from the e-filing website.

Apart from the above, in case of ITR-1 and ITR-4, the e-filing website also provides the ITR form in the webpage version. For using the web version, no software is required to be downloaded and a taxpayer can directly fill the data on the e-filing website and then file the ITR therefrom directly. It has the facility of saving the draft data and hence one is not required to finish the data filling at one go. It also prefills the ITR form automatically. It is simple and widely used by most of the taxpayers who file ITR-1. An active internet connection is always required while using the ITR form. Without an internet connection, the web version cannot be used. Further, the ITR 1 cannot be filed with digital signature under this web version.

A screenshot of ITR-1 web version for AY 2019-20:

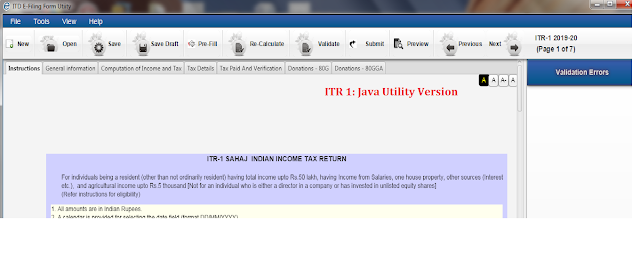

The Java version of the utility runs on the desktop. The utility is required to be downloaded from the e-filing website and then can be used without an internet connection. It's an offline utility. One needs to download pre-filled XML from the e-filing portal for prefilling the ITR form. The data can be saved as a draft pending final uploading. This utility has the feature of direct uploading of the ITR form on the e-filing website from the utility itself with or without digital signature. However, for ITR form filed without digital signature, logging into the website is required for e-verification through EVC.

A screenshot of ITR-1 Java Utility version for AY 2019-20:

The Excel Version utility is based on MS-Excel. The utility is required to be downloaded from the e-filing website of the income tax department. Many find it simple because of the known MS-Excel interface. It can be used without any internet connection. The Excel utility is macro based thus macro must be enabled to use the utility. For filing the ITR form, one needs to generate the XML file and then have to upload the same on the e-filing portal after logging into the account.

A screenshot of ITR-1 Excel version for AY 2019-20:

Step 2: Logging to taxpayers account with User-ID (which is the PAN of the taxpayer) and password. Enter the Captcha and then click 'Login'.

A new window will open. Select the 'Assessment year' as 2019-20 and then select 'ITR Form Name' as 'ITR-1'. Click 'Continue'.

After completing and understanding the above steps, let us begin the step-by-step guide to file the ITR 1 for the AY 2019-20. The guide is made for the web version of the ITR-1 filing software. The Java and Excel-based utilities are almost in a similar line of the web version.Step-1: Open the e-filing website on the browser. For this visit https://www.incometaxindiaefiling.gov.in/

As stated above it is now mandatory to file the income tax return in online mode only except in case of very senior citizens for ITR-1 and ITR-4 only. No paper format of return or manual return is possible. The income-tax department has provided various software at free of cost for all the ITR forms including ITR-1 on its e-filing website. In the case of software utilities, two versions are also provided. One is Excel-based utility and the other one is Java-based utility. One can use any one of the software version for filing of ITR forms as per taxpayers' convenience after downloading the same from the e-filing website.

Apart from the above, in case of ITR-1 and ITR-4, the e-filing website also provides the ITR form in the webpage version. For using the web version, no software is required to be downloaded and a taxpayer can directly fill the data on the e-filing website and then file the ITR therefrom directly. It has the facility of saving the draft data and hence one is not required to finish the data filling at one go. It also prefills the ITR form automatically. It is simple and widely used by most of the taxpayers who file ITR-1. An active internet connection is always required while using the ITR form. Without an internet connection, the web version cannot be used. Further, the ITR 1 cannot be filed with digital signature under this web version.

A screenshot of ITR-1 web version for AY 2019-20:

The Java version of the utility runs on the desktop. The utility is required to be downloaded from the e-filing website and then can be used without an internet connection. It's an offline utility. One needs to download pre-filled XML from the e-filing portal for prefilling the ITR form. The data can be saved as a draft pending final uploading. This utility has the feature of direct uploading of the ITR form on the e-filing website from the utility itself with or without digital signature. However, for ITR form filed without digital signature, logging into the website is required for e-verification through EVC.

A screenshot of ITR-1 Java Utility version for AY 2019-20:

The Excel Version utility is based on MS-Excel. The utility is required to be downloaded from the e-filing website of the income tax department. Many find it simple because of the known MS-Excel interface. It can be used without any internet connection. The Excel utility is macro based thus macro must be enabled to use the utility. For filing the ITR form, one needs to generate the XML file and then have to upload the same on the e-filing portal after logging into the account.

A screenshot of ITR-1 Excel version for AY 2019-20:

Pre-filling of ITR forms and Prevalidation of Bank Account-

Pre-filling of ITR forms: The income-tax department has introduced the facility to pre-fill the income tax returns or ITRs for making the filing of ITRs more convenient for the Assessment Year 2019-20. Earlier, the features were not enabled. Now the ITRs will be prefilled for Salary Income, FD Interest Income, and TDS details. However, taxpayers are cautioned that this is the facility to make the filing of ITRs easier and taxpayers should verify the same before filing the ITR. Read more on Prefilled ITR for taxpayers convenience.

Prevalidation of Bank Account: With effect from 1st March 2019, no income-tax refund from Assessment Year 2019-20 if PAN and Bank are not linked. The refund will be denied even if proper bank account for receiving the income-tax refund is given in the Income Tax Return (ITR). To know more, read - What is linking of a bank account with PAN, what is prevalidation of bank account and how is it done.

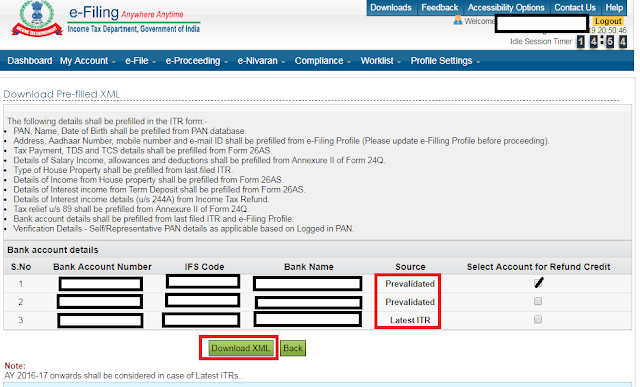

How to download pre-fill XML?

If the ITR-1 is filed by using the software utility (Java based or Excel based), then the ITR form is required to be pre-filled manually. If the web version is used for ITR-1 filing, the same is auto pre-filled.

One is required to download a file called Pre-filled XML from the e-filing website and then import the same in Excel or Java utility. The step to download and import the pre-filled file is given under-

Step-1: Open the e-filing website on the browser. For this visit https://www.incometaxindiaefiling.gov.in/

Step 2: Logging to taxpayers account with User-ID (which is the PAN of the taxpayer) and password. Enter the Captcha and then click 'Login'.

Step 3: Go to 'My Account' tab/menu and select 'Download Pre-filled XML'.

A new window will open. Select the 'Assessment year' as 2019-20 and then select 'ITR Form Name' as 'ITR-1'. Click 'Continue'.

Step 4: In the new window, select the bank account for refund credit. If the bank account is already prevalidated, then under the 'Source' column, 'Prevalidated' will be written else 'Latest ITR' will be shown. For refund purpose, select only the pre-validated bank account.

Step 5: Click on the 'Download XML'. An XML file will be downloaded. The download process is complete. This XML file is imported into the Java or Excel utility.

A video presentation of the step-by-step guide to download pre-filled XML from income tax e-filing website is given here.

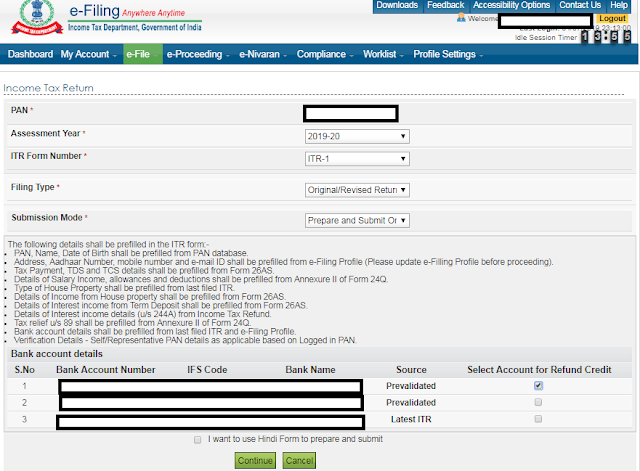

After completing and understanding the above steps, let us begin the step-by-step guide to file the ITR 1 for the AY 2019-20. The guide is made for the web version of the ITR-1 filing software. The Java and Excel-based utilities are almost in a similar line of the web version.Step-1: Open the e-filing website on the browser. For this visit https://www.incometaxindiaefiling.gov.in/

Step 2: Logging to taxpayers account with User-ID (which is the PAN of the taxpayer) and password. Enter the Captcha and then click 'Login'.

Step 3: On the landing page, click on 'Filing of Income Tax Return'.

Step 4: On the new window, select 'Assessment Year' as 2019-20, 'ITR Form Number' as ITR-1, 'Filing Type' as 'Original/Revised Return' and for the 'Submission Mode' select 'Prepare and Submit online'. The other option 'Upload XML' shall be ignored since we are filing on webpage version. This mode with 'Upload XML' is required to be selected if the filing is done from Excel or Java-based utility.

Select the bank account for refund credit. If the bank account is already pre-validated, then under the 'Source' column, 'Prevalidated' will be written else 'Latest ITR' will be shown. For refund purpose, select only the pre-validated bank account.

Click on the 'Continue' button.

This will open the following form of ITR 1. The First Tab is 'Instructions'. One may read the instructions carefully before proceeding to fill and file the return in ITR 1.

Besides, it has three command buttons-

a) Preview and Submit - To preview the filled-in data before submitting the ITR 1.

b) Save Data - To save the current filled-in data for future use.

c) Exit - To exit from the ITR Form page.

The two arrows are the navigation keys to move to the next tab of the page or form.

Caution: One should not click on any other menu of the website else he will exit from the ITR Form page.

Apart from the 'Instruction' tab, this page or form has 6 other tabs namely-

Part-A General Information: Contains various Personal Information of the taxpayer. Mostly, the data are pre-filled. The taxpayer should verify the same and shall make the necessary correction. If any field or data is not pre-filled, the taxpayer should fill the data.

Computation of Income and Tax: Contains the details of income of the taxpayer and computes the 'Total Income'. The tax liability with rebate etc. is auto calculated.

Tax Details: Contains details of TDS by various deductors including employer, TCS, if any, Advance taxes and self-assessment taxes paid, if any. These data are pre-filled. However, if the data are not pre-filled or wrong pre-filled, taxpayers should modify the data.

Taxes Paid and Verification: Contains the total of taxes paid and tax payable or refundable. It also contains the verification of the ITR Form by the taxpayer and the verification option.

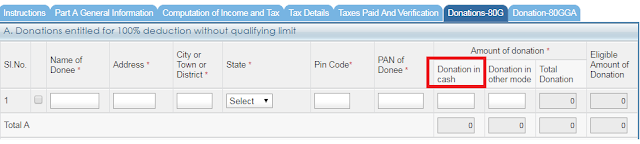

Donation-80G: Contains the details of donations made by the taxpayer during the FY 2018-19 which qualifies for deduction under section 80G.

Donation-80GGA: Contains the details of donations made by the taxpayer during the FY 2018-19 which qualifies for deduction under section 80GGA.

Step 5: Click on the tab captioned as 'Part-A General Information'. It is divided into two blocks. The first block contains various personal information which is pre-filled. Except for the 'PAN' and 'Last Name', every other field is editable. A taxpayer may edit the fields if any correction is required in any of the fields. If a taxpayer changes the mobile number, email, and address, he should also make the changes in the profile page. For this, go to ' 'Profile settings'>'My Profile'. Before clicking the 'Profile settings' menu, do not forget to save the data. This may be edited later on also.

As stated earlier, if any other menu is clicked from the ITR form page, then he will be taken out of the form page. To visit the ITR form page again, click on 'Dashboard'>'Filing of Income Tax Return'.

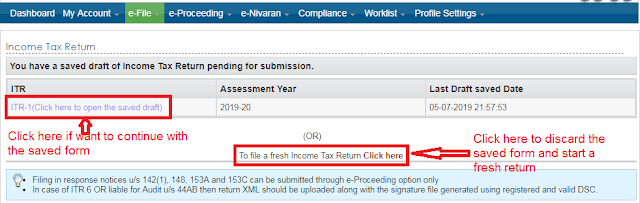

This time the screen will appear like this-

To continue with the saved draft, click on the 'ITR 1 (Click here to open the saved draft)'. Once the link is clicked, click the 'Continue' button and the saved page of the ITR form will appear on the screen.

One may discard the saved form and start a new fresh form filling by clicking the appropriate link.

Aadhaar Number: For the AY 2019-20 it is mandatory to link the Aadhaar Number with PAN. If PAN and Aadhaar Number is not linked, ITR-1 cannot be filed.

CBDT Circular for quoting of Aadhaar number in ITR

CBDT Notification for PAN and Aadhaar linking

In the second block, a taxpayer needs to fill the following details-

1. Nature of employment: If the individual has income from salary then select the appropriate category of employer viz, Government or Public Sector Undertakings. For those working in private sectors, should select 'Others'. If the taxpayer is an ex-employee and is earning pension income, then he should select 'Pensioners'. This new category is inserted from this year.

If the taxpayer is filing the ITR 1 only for interest income or rental income and has no income from salary then select 'Not Applicable'.

Step 5: Click on the tab captioned as 'Part-A General Information'. It is divided into two blocks. The first block contains various personal information which is pre-filled. Except for the 'PAN' and 'Last Name', every other field is editable. A taxpayer may edit the fields if any correction is required in any of the fields. If a taxpayer changes the mobile number, email, and address, he should also make the changes in the profile page. For this, go to ' 'Profile settings'>'My Profile'. Before clicking the 'Profile settings' menu, do not forget to save the data. This may be edited later on also.

As stated earlier, if any other menu is clicked from the ITR form page, then he will be taken out of the form page. To visit the ITR form page again, click on 'Dashboard'>'Filing of Income Tax Return'.

This time the screen will appear like this-

To continue with the saved draft, click on the 'ITR 1 (Click here to open the saved draft)'. Once the link is clicked, click the 'Continue' button and the saved page of the ITR form will appear on the screen.

One may discard the saved form and start a new fresh form filling by clicking the appropriate link.

Aadhaar Number: For the AY 2019-20 it is mandatory to link the Aadhaar Number with PAN. If PAN and Aadhaar Number is not linked, ITR-1 cannot be filed.

CBDT Circular for quoting of Aadhaar number in ITR

CBDT Notification for PAN and Aadhaar linking

In the second block, a taxpayer needs to fill the following details-

1. Nature of employment: If the individual has income from salary then select the appropriate category of employer viz, Government or Public Sector Undertakings. For those working in private sectors, should select 'Others'. If the taxpayer is an ex-employee and is earning pension income, then he should select 'Pensioners'. This new category is inserted from this year.

If the taxpayer is filing the ITR 1 only for interest income or rental income and has no income from salary then select 'Not Applicable'.

2. Filing status of return: In column A20, select the option titled 'Filed u/s' since this return is being filed by the taxpayer on his own. In the second column titled 'Filed u/s' with red asterisk mark, select the applicable section under which the return in ITR 1 is being filed.

If the ITR 1 is being filed within due date 31st July 2019, select '139(1)-On or before the due date'.

If the ITR 1 is being filed after the due date of 31st July 2019 but within 31st March 2020, select '139(4)-Belated'.

If the ITR 1 is not the original one but a revised ITR (which means original ITR 1 was already filed) then select '139(5)-Revised'. In the case of a revised return, ITR 1 acknowledgment number and date of filing of original return needs to be furnished. these cells were activated then. Since this article is focussing on the original return, this aspect is not covered in detail. When a return in ITR 1 is filed for the first time for AY 2019-20 it will always be an original return.

Step 6: After completing the 'Part-A General Information', the taxpayer should move to the next tab either by clicking the tab header or the green cloured right arrow. in the meantime, do not forget to save the data by clicking the 'Save Data' button. It should be done occasionally even if not mentioned in this article in the steps of filing of ITR 1.

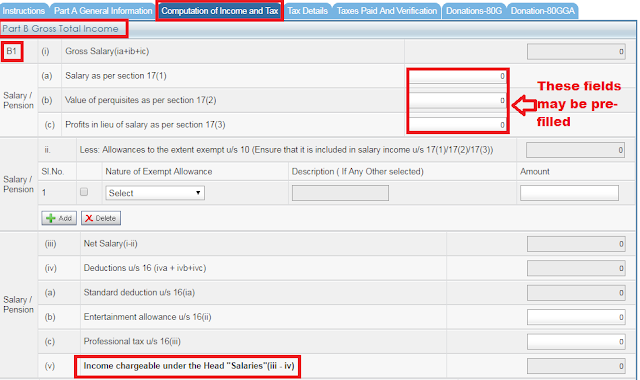

The next tab is titled as 'Computation of Income and Tax'.

This tab contains three parts-

The first block 'B1' is related to Salary Income. Some of the fields may be pre-filled viz-

If the same is not pre-filled one may fill the same from the Part-B of Form 16 issued by the employer. These fields are editable.

Exempt allowances are required to be taken from the Part-B of Form 16. However, if the employer did not consider any exemption which the employee thinks is eligible to get, the same may be considered here. For example, if the employer did not consider the exemption for LTA, the taxpayer may claim the same in the ITR 1 if he is otherwise eligible to claim the exemption.

Similarly, if the employer did not consider the rent payment for HRA exemption due to the fact that the employee or taxpayer did not submit the rent receipts to the employer, the same may be claimed by the taxpayer if he is otherwise eligible.

In these cases, the taxpayer must ensure to keep the documentary evidence properly as he may receive a query from the income tax department due to the discrepancy in the exemption from salary reported by the employer to the income tax department and the exemption from salary claimed by the employee or taxpayer.

Deduction u/s 16, if not pre-filled, shall be entered by the taxpayer from PArt B of Form 16 for -

The Budget 2018 has introduced the standard deduction to be allowed from income chargeable under the head 'Salary'. The maximum amount of standard deduction to be allowed from salary income for FY 2018-19 is limited to Rs. 40,000.

It is pertinent to note that only the relevant fields are activated. It means if the nature of employment in the preceding tab is selected as 'Others' for a private sector employee, the field for Entertainment Allowance u/s 16(ii) is disabled and no data can be entered there. This is because Entertainment Allowance u/s 16(ii) is allowed only to government employees. For 'Pensioners', only the 'Standard Deduction' filed is enabled, rest are disabled. This will reduce data entry error.

This will compute the 'Income chargeable under the head salaries' for the AY 2019-20.

The next block 'B2' is related to Income from one house property. If the taxpayer has more than one house property, ITR 1 cannot be filed. The one house property may be self-occupied, let-out or deemed to be let-out. Inbuilt validations of cells are incorporated. If the taxpayer selects the type of house property as 'self-occupied' only the 'Interest payable on borrowed capital' gets activated. Other fields being irrelevant are disabled and no data can be entered to those disabled cells.

Further, note that in the case of self-occupied house property, the maximum amount of interest on home loan that can be claimed for the FY 2018-19 is Rs. 2,00,000. Any interest paid or payable in excess of Rs. 2,00,000 for a self-occupied house property is lost forever.

If the taxpayer selects the type of property as 'let-out' or 'deemed to be let-out', then cells B-2-(i) and B-2-(ii) for 'Gross rent receipt' and 'Municipal taxes paid' respectively are activated.

If the house property is let-out then there is no limit in claiming the interest on home loan payable during the FY 2018-19. In case of let-out house property, interest on home loan even if exceeds Rs. 2,00,000 is allowed. However, please note that maximum interest of Rs. 2,00,000 can be set-off or adjusted in an assessment year. Interest paid in excess of Rs. 2,00,000 in case of a let-out property is carried forward for adjustment in succeeding assessment years. No carry forward of unadjusted interest in excess of Rs. 2,00,000 is allowed in ITR 1. To avail the benefit of carry forward and set-off of loss, one may use ITR 2 instead of ITR 1.

Therefore, a taxpayer should file ITR 1 only if the interest paid or payable on home loan for a let-out house property exceeds Rs. 2,00,000.

This will compute the 'Income chargeable under the head House Property' for the AY 2019-20.

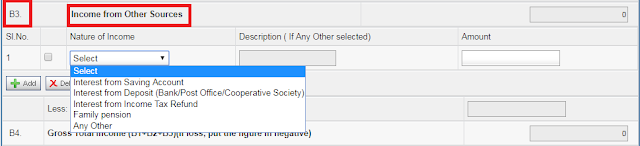

The next block 'B3' is related to 'Income from Other Sources'.

This year the ITR 1 form is changed to report income from other sources viz.-

Interest from Savings Account - Against this, deduction u/s 80TTA is allowed up to Rs. 10,000.

Interest from Deposits - It includes income from FD, Recurring deposits, bonds, debentures, etc. The income is reported in Form 26AS if tax is deducted or Form 15G or Form 15H is filed. A senior citizen can claim deduction for interest income u/s 80TTB upto Rs. 50,000 for AY 2019-20.

Interest from income tax refund - It is pre-filled if any income is earned during FY 2018-19.

Family Pension - Pension received by the family member of the deceased employee. In ITR-1, only expenses u/s 57(iia) can be claimed. Section 57(iia) is a deduction available from family pension income and is equal to 33 1/3 percent of such income or Rs. 15,000, whichever is less.

Detailed break-up of income from other sources should be given instead of one consolidated figure. In case ‘Any Other’ is selected then the nature of such other income shall be written in the ‘Description’. The income from other sources shall not include winnings from lottery or income from race horses. Therefore, in 'Any Other' heading, these nature of income cannot be included.

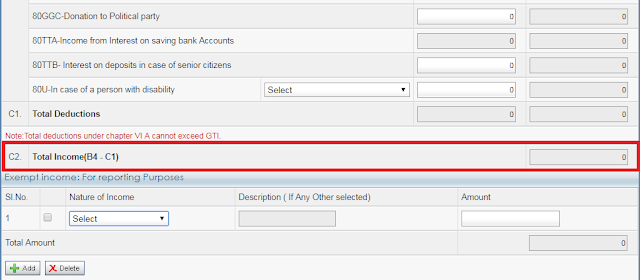

After completing the income part, its turn to fill the 'Part C: Deductions and Taxable Total Income' in the same tab. Basically, it includes the deduction available to an Individual under chapter VI A of the Income Tax Act, 1961 covering sections 80C to 80U. A taxpayer can fill the same from the Part B of Form 16 or from own records. For claiming deduction u/s 80G or u/s 80GGA, separate tabs are given which can be filled to claim the deduction.

If the ITR 1 is being filed within due date 31st July 2019, select '139(1)-On or before the due date'.

If the ITR 1 is being filed after the due date of 31st July 2019 but within 31st March 2020, select '139(4)-Belated'.

If the ITR 1 is not the original one but a revised ITR (which means original ITR 1 was already filed) then select '139(5)-Revised'. In the case of a revised return, ITR 1 acknowledgment number and date of filing of original return needs to be furnished. these cells were activated then. Since this article is focussing on the original return, this aspect is not covered in detail. When a return in ITR 1 is filed for the first time for AY 2019-20 it will always be an original return.

Step 6: After completing the 'Part-A General Information', the taxpayer should move to the next tab either by clicking the tab header or the green cloured right arrow. in the meantime, do not forget to save the data by clicking the 'Save Data' button. It should be done occasionally even if not mentioned in this article in the steps of filing of ITR 1.

The next tab is titled as 'Computation of Income and Tax'.

This tab contains three parts-

- Part B: Gross Total Income

- Part C: Deductions and Taxable Total Income

- Part D: Computation of tax payable

The first block 'B1' is related to Salary Income. Some of the fields may be pre-filled viz-

- Salary as per section 17(1)

- Value of perquisites as per section 17(2)

- Profits in lieu of salary as per section 17(3)

If the same is not pre-filled one may fill the same from the Part-B of Form 16 issued by the employer. These fields are editable.

Exempt allowances are required to be taken from the Part-B of Form 16. However, if the employer did not consider any exemption which the employee thinks is eligible to get, the same may be considered here. For example, if the employer did not consider the exemption for LTA, the taxpayer may claim the same in the ITR 1 if he is otherwise eligible to claim the exemption.

Similarly, if the employer did not consider the rent payment for HRA exemption due to the fact that the employee or taxpayer did not submit the rent receipts to the employer, the same may be claimed by the taxpayer if he is otherwise eligible.

In these cases, the taxpayer must ensure to keep the documentary evidence properly as he may receive a query from the income tax department due to the discrepancy in the exemption from salary reported by the employer to the income tax department and the exemption from salary claimed by the employee or taxpayer.

Deduction u/s 16, if not pre-filled, shall be entered by the taxpayer from PArt B of Form 16 for -

- Standard Deduction u/s 16(ia)

- Entertainment Allowance u/s 16(ii)

- Professional Tax u/s 16(iii)

The Budget 2018 has introduced the standard deduction to be allowed from income chargeable under the head 'Salary'. The maximum amount of standard deduction to be allowed from salary income for FY 2018-19 is limited to Rs. 40,000.

It is pertinent to note that only the relevant fields are activated. It means if the nature of employment in the preceding tab is selected as 'Others' for a private sector employee, the field for Entertainment Allowance u/s 16(ii) is disabled and no data can be entered there. This is because Entertainment Allowance u/s 16(ii) is allowed only to government employees. For 'Pensioners', only the 'Standard Deduction' filed is enabled, rest are disabled. This will reduce data entry error.

This will compute the 'Income chargeable under the head salaries' for the AY 2019-20.

The next block 'B2' is related to Income from one house property. If the taxpayer has more than one house property, ITR 1 cannot be filed. The one house property may be self-occupied, let-out or deemed to be let-out. Inbuilt validations of cells are incorporated. If the taxpayer selects the type of house property as 'self-occupied' only the 'Interest payable on borrowed capital' gets activated. Other fields being irrelevant are disabled and no data can be entered to those disabled cells.

Further, note that in the case of self-occupied house property, the maximum amount of interest on home loan that can be claimed for the FY 2018-19 is Rs. 2,00,000. Any interest paid or payable in excess of Rs. 2,00,000 for a self-occupied house property is lost forever.

If the taxpayer selects the type of property as 'let-out' or 'deemed to be let-out', then cells B-2-(i) and B-2-(ii) for 'Gross rent receipt' and 'Municipal taxes paid' respectively are activated.

If the house property is let-out then there is no limit in claiming the interest on home loan payable during the FY 2018-19. In case of let-out house property, interest on home loan even if exceeds Rs. 2,00,000 is allowed. However, please note that maximum interest of Rs. 2,00,000 can be set-off or adjusted in an assessment year. Interest paid in excess of Rs. 2,00,000 in case of a let-out property is carried forward for adjustment in succeeding assessment years. No carry forward of unadjusted interest in excess of Rs. 2,00,000 is allowed in ITR 1. To avail the benefit of carry forward and set-off of loss, one may use ITR 2 instead of ITR 1.

Therefore, a taxpayer should file ITR 1 only if the interest paid or payable on home loan for a let-out house property exceeds Rs. 2,00,000.

This will compute the 'Income chargeable under the head House Property' for the AY 2019-20.

The next block 'B3' is related to 'Income from Other Sources'.

This year the ITR 1 form is changed to report income from other sources viz.-

Interest from Savings Account - Against this, deduction u/s 80TTA is allowed up to Rs. 10,000.

Interest from Deposits - It includes income from FD, Recurring deposits, bonds, debentures, etc. The income is reported in Form 26AS if tax is deducted or Form 15G or Form 15H is filed. A senior citizen can claim deduction for interest income u/s 80TTB upto Rs. 50,000 for AY 2019-20.

Interest from income tax refund - It is pre-filled if any income is earned during FY 2018-19.

Family Pension - Pension received by the family member of the deceased employee. In ITR-1, only expenses u/s 57(iia) can be claimed. Section 57(iia) is a deduction available from family pension income and is equal to 33 1/3 percent of such income or Rs. 15,000, whichever is less.

Detailed break-up of income from other sources should be given instead of one consolidated figure. In case ‘Any Other’ is selected then the nature of such other income shall be written in the ‘Description’. The income from other sources shall not include winnings from lottery or income from race horses. Therefore, in 'Any Other' heading, these nature of income cannot be included.

After completing the income part, its turn to fill the 'Part C: Deductions and Taxable Total Income' in the same tab. Basically, it includes the deduction available to an Individual under chapter VI A of the Income Tax Act, 1961 covering sections 80C to 80U. A taxpayer can fill the same from the Part B of Form 16 or from own records. For claiming deduction u/s 80G or u/s 80GGA, separate tabs are given which can be filled to claim the deduction.

In case of deduction u/s 80G and 80GGA, Donation in cash is required to be reported separately. Please note that in case of donation made in cash in excess of Rs. 2,000, no deduction will be allowed.

A new tab for Deduction u/s 80GGA is inserted in ITR-1. This section provides a deduction for the donations made for scientific research or rural development. One should claim the deduction under the relevant clauses.

If the employer did not consider any deduction which the employee thinks is eligible to get, the same may be considered here. For example, if the employer did not consider the deduction for donation u/s 80G the taxpayer may claim the same in the ITR 1 if he is otherwise eligible to claim the exemption.

Similarly, if the employer did not consider the insurance premium payment due to the fact that the employee or taxpayer did not submit the same to the employer, the same may be claimed by the taxpayer if he is otherwise eligible.

In these cases, the taxpayer must ensure to keep the documentary evidence properly as he may receive a query from the income tax department due to the discrepancy in the amount of deduction reported by the employer to the income tax department and the amount of deduction claimed by the employee or taxpayer.

After the deduction part is filled and complete, the software will auto calculate the Total Income of the taxpayer.

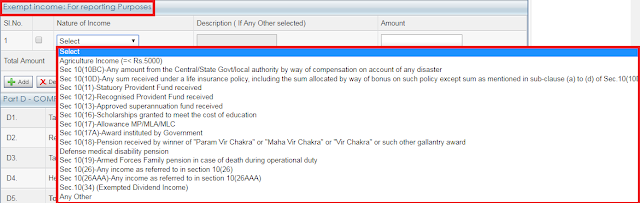

After the Total Income is computed, the next step is to report the exempt income. Exempt income is for reporting purpose only and does not form part of total income. It is highly desirable that taxpayers should report the exempt income as per the prescribed details. In case 'Any Other' is selected its nature should be described in the 'Description' field.

Exempt income that salaried individuals generally earn are-

Click on 'Save Draft' button to Save the form.

Step 7: After completing the 'Computation of Income and Tax', the taxpayer should move to the next tab either by clicking the tab header or the green cloured right arrow.

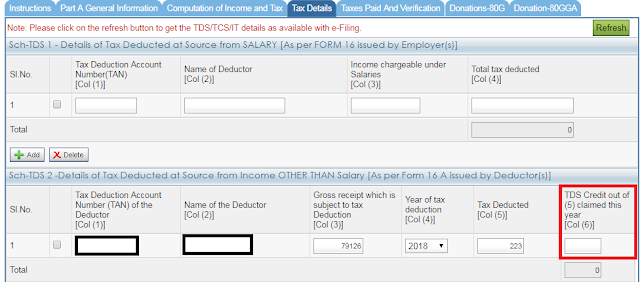

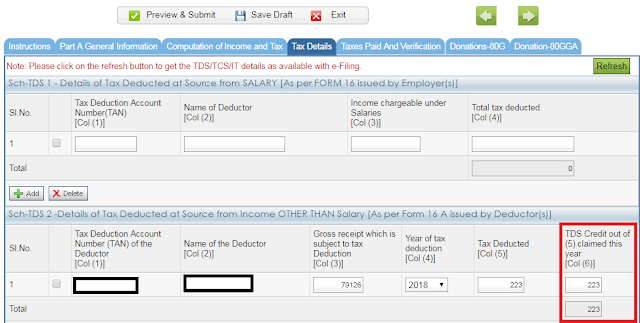

The next tab is titled as 'Tax Details' and consists of TDS by the employer, TDS by other deductors like banks, etc., TCS, and details of Advance Tax & Self-assessment tax payments.

Normally, this tab will be pre-filled. If the taxpayer finds any data is missing, the same may be manually added. In case of self-assessment tax which is paid just before the filing of return in ITR 1, the data for the same is required to be added manually in the 'Sch IT-Details of Advance Tax and Self-assessment tax payments'.

In this context, it is important to note that if the taxpayer has claimed TDS in the current assessment year 2019-20 then the income has to be offered in the Gross Total Income in the tab titled 'Computation of Income and Tax'. Thus if the Sch-TDS 2 contain information regarding Interest income, the same should be included in Gross Total Income under the head 'Income from other sources in Interest from Deposits field. For example, for the given images, the interest income of Rs. 79,126 must be included in the Income from other sources. The income from deposits shall be equal to or higher than the amount of income reported in the Form 26AS from where the Sch-TDS 2 is pre-filled.

Further, don't forget to fill the Col(6) of 'Sch-TDS 2 -Details of Tax Deducted at Source from Income OTHER THAN Salary [As per Form 16 A issued by Deductor(s)]', else credit for TDS will not be given.

Don't fill the Sch-TDS 2 like this-

Fill the Sch-TDS 2 like this-

Similarly, if the employer did not consider the insurance premium payment due to the fact that the employee or taxpayer did not submit the same to the employer, the same may be claimed by the taxpayer if he is otherwise eligible.

In these cases, the taxpayer must ensure to keep the documentary evidence properly as he may receive a query from the income tax department due to the discrepancy in the amount of deduction reported by the employer to the income tax department and the amount of deduction claimed by the employee or taxpayer.

After the deduction part is filled and complete, the software will auto calculate the Total Income of the taxpayer.

After the Total Income is computed, the next step is to report the exempt income. Exempt income is for reporting purpose only and does not form part of total income. It is highly desirable that taxpayers should report the exempt income as per the prescribed details. In case 'Any Other' is selected its nature should be described in the 'Description' field.

Exempt income that salaried individuals generally earn are-

- Interest on PPF,

- Interest on EPF,

- Interest from Tax-free bonds,

- Exempt life insurance proceeds, etc.

Click on 'Save Draft' button to Save the form.

Step 7: After completing the 'Computation of Income and Tax', the taxpayer should move to the next tab either by clicking the tab header or the green cloured right arrow.

The next tab is titled as 'Tax Details' and consists of TDS by the employer, TDS by other deductors like banks, etc., TCS, and details of Advance Tax & Self-assessment tax payments.

Normally, this tab will be pre-filled. If the taxpayer finds any data is missing, the same may be manually added. In case of self-assessment tax which is paid just before the filing of return in ITR 1, the data for the same is required to be added manually in the 'Sch IT-Details of Advance Tax and Self-assessment tax payments'.

In this context, it is important to note that if the taxpayer has claimed TDS in the current assessment year 2019-20 then the income has to be offered in the Gross Total Income in the tab titled 'Computation of Income and Tax'. Thus if the Sch-TDS 2 contain information regarding Interest income, the same should be included in Gross Total Income under the head 'Income from other sources in Interest from Deposits field. For example, for the given images, the interest income of Rs. 79,126 must be included in the Income from other sources. The income from deposits shall be equal to or higher than the amount of income reported in the Form 26AS from where the Sch-TDS 2 is pre-filled.

Further, don't forget to fill the Col(6) of 'Sch-TDS 2 -Details of Tax Deducted at Source from Income OTHER THAN Salary [As per Form 16 A issued by Deductor(s)]', else credit for TDS will not be given.

Don't fill the Sch-TDS 2 like this-

Fill the Sch-TDS 2 like this-

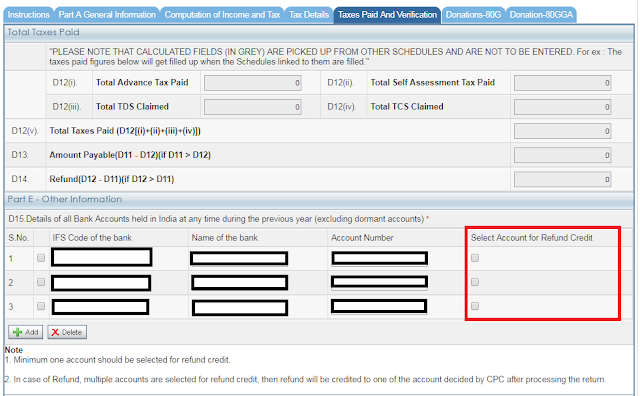

Step 8: After completing the 'Tax Details', the taxpayer should move to the next tab either by clicking the tab header or the green cloured right arrow.

The next tab is titled as 'Taxes Paid and Verification' and consists of the aggregate of Total TDS and TCS claimed, and Total Advance Tax & Self-assessment tax paid. The difference between the tax liability as determined in Column D 11 of tab 'Computation of Income and Tax' and the Total taxes paid will show the refund or tax payable, as the case may be.

If the result is showing as tax payable, the same needs to be paid as 'self-assessment tax' and the challan details are required to be filled in the 'Sch IT-Details of Advance Tax and Self-assessment tax payments' of tab 'Tax Details'. After the payment of the tax and filling the challan details, there will be no tax payable.

If the result is showing as tax refundable, then in the bank details under the 'Part E - Other Information', select anyone prevalidated bank account for receiving the refund. Even if there is no tax refund, the taxpayer should select one bank account before filing the ITR 1.

In the 'Verification', the name and PAN of the taxpayer, taxpayer's father name and the date will be pre-filled. The taxpayer has to fill the 'Place' and the capacity as 'Self'.

Select any one of the verification options as per the taxpayer's convenience and thereafter the income tax return in ITR may be filed.

After the filing of the return form is complete in all respects, then click on the 'Preview and Submit' button. The next screen will show the 'Preview' of the form. Check it once. If found any mistake, click on 'Edit' to return to form filling mode. If there is no error, click on the 'Submit' button.

A confirmation message with a Transaction ID of the filing of return will appear on the screen. A copy of the ITR-V (Acknowledgment) is also sent to the email id of the taxpayer.

The return in ITR 1 for AY 2019-20 is filed successfully. The date when the return is filed is the date of filing of return if the same is successfully verified with 120 days of filing. One can click on the appropriate link to e-verify the return filed.

Please note that this is the filing of the return only which needs to be verified within 120 days of the filing of the return else the return will become invalid. An invalid return means that no return of income has been filed for the relevant assessment year. Therefore, it is very important to verify the return filed either manually or electronically.

Conclusion:

The process of filing of ITR 1 is very simple and can be filed by an ordinary taxpayer with certain basic understandings. Though every effort is given to clear the doubts of independent return filers in ITR 1, in case of any doubt or query one may ask me in the comment section.

Get all latest content delivered straight to your inbox

0 Comments