|

| Image Source: https://www.incometaxindiaefiling.gov.in/home |

With effect from 1st March 2019, no income-tax refund from Assessment Year 2019-20 if PAN and Bank are not linked. The refund will be denied even if proper bank account for receiving income tax refund is given in the Income Tax Return (ITR).

Many people are already started receiving notices from Income Tax CPC that their refund cannot be processed due to PAN not linked to Bank account.

In this article, we will be discussing on what is the linking of PAN and Bank account and how to link PAN and bank account for the income-tax refund to avoid failure of income tax refund due to PAN not linked to Bank account.

Overview

In February 2019, the Income Tax department had announced that effective 01st March 2019 all the income-tax refund will be made in e-mode only. That is income-tax refund will not be made in cheques and will be directly credited to the assessee’s bank account. For this purpose, it is now mandatory to link bank account with the PAN of the assessee failing which no refund will be made to the assessee.

Which bank accounts are covered under the PAN and Bank linking for income-tax refund?

As per the communication issued by the department, the bank account could be savings account, current account or overdraft account.

How to link PAN with Bank account for income-tax refund purpose?

The simple answer is PAN number registered with a bank account is the linking of PAN with a bank account. Normally, at the time of opening a bank account or at the time of updating KYC of a bank account, PAN is given to bank personnel for registering the PAN in the bank account. Many a time, PAN is also submitted to bank to avoid higher TDS on interest etc. When the bank registers the PAN in the bank account of an individual/person, the bank account is linked with PAN and is sufficient for the purpose of income-tax refund.

In case PAN is not registered with a bank account then one needs to visit the branch of the the bank where the individual has the bank account and shall submit a copy of his PAN card for registering in his bank account. Once the PAN is registered into the bank account of the person/individual, linking of PAN with Bank gets completed.

What is Pre-validation of Bank account for income-tax refund?

After the PAN is linked with Bank account one has to pre-validate the bank account on the income-tax e-filing website. If the PAN is already registered with bank account or linked with bank account then one should directly do the pre-validation of the bank account. The e-filing website mandates that the bank account must be registered with a mobile number for pre-validating the bank account.

In case mobile number is not registered with a bank account or if one needs to change the registered mobile number with a bank account then one needs to visit the branch of the bank where the individual has the bank account. Instead, this may be done online on the bank website if the bank so provides the facility.

Also read:

CBDT Circular for quoting of Aadhaar number in ITR

CBDT Notification for linking PAN with Aadhaar

No tax on Income up to Rs. 5 Lakh as per Interim Budget 2019

Why the government has extended the linking of PAN and Aadhaar number from 31.03.2019 to 30.09.2019?

How to Pre-validate a Bank account for income-tax refund when PAN and Bank is linked?

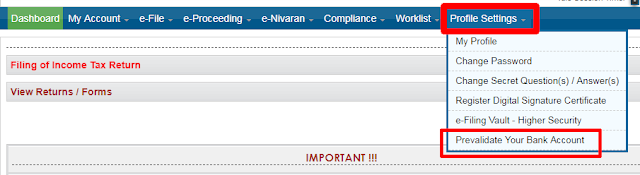

The step-by-step guide to pre-validating a bank account on the income-tax e-filing website is given below (with screenshots)-

Step 1: Visit www.incometaxindiaefiling.com

Step 2: Log in portal with User ID and Password. In case one is not registered, he has to get compulsorily registered for pre-validating a bank account.

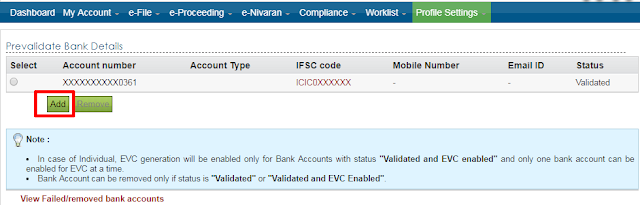

Step 5: In case any bank account is already pre-validated, it will show a list of bank accounts already pre-validated. In case one wish to pre-validate a new bank account, Click ‘Add ’ and go to step 6, else one may exit at this step.

Step 6: In case no bank account is pre-validated or on clicking ‘Add’ button as stated in Step 5 above, a new page will open which will seek the following information –

PAN and Name as in PAN is auto-filled cells. One has to fill the IFSC code of the bank account, Bank account Number, Type of account and Mobile number registered with the bank (and not registered on the e-filing website or in ITR). Once the IFSC code is filled, the website will automatically fill the name of the bank.

Step 7: Click ‘Prevalidate’ to continue or ‘Cancel’ to end the validation process. On clicking ‘Prevalidate’, a message will appear that your information is submitted to bank for verification. To check the result, go to step 8.

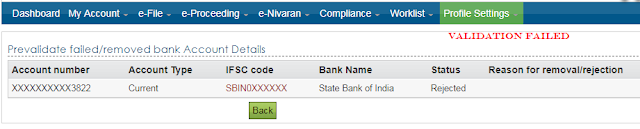

Step 8: Click again ‘Profile>Prevalidate Your Bank account’. The result will be shown in the new page whether validation is successful or failed. If failed, the reasons will be e-mailed to your email-id as mentioned in the e-filing website or ITR. E-mail is also sent for successful validation of bank account. If verification is successful, the pre-validation is complete and exit at this step. If pre-validation is failed, then go to Step 9.

Click ‘View Failed/removed bank accounts’ to get the status if the same is not showing on the main page.

Step 9: If pre-validation fails, check the reasons mentioned in the e-mail. Make the necessary corrections. Many times the pre-validation fails due to error from bank’s server. In those cases, please wait for some time and repeat the above-mentioned steps at a later time.

What if one has more than one bank account in the context of linking of PAN with Bank account for income-tax refund?

There is no problem if one has more than one bank account with the same bank or different banks and all of such bank account s are registered with PAN and also have same or different registered mobile numbers. The requirement is that at least one bank account must be registered or linked with PAN and mobile number. Moreover, more than one bank account can be pre-validated and then refund will be issued in the bank account as indicated in the e-filed ITR.

What if bank account is already pre-validated earlier for validating ITR through EVC?

One of the made of e-verification of e-filed Income Tax Returns (ITRs) is by EVC generated through net banking or by pre-validating a bank account. In case one has e-verified the ITR earlier after pre-validating the bank account, nothing has to be done as the PAN is already linked with the bank account and the pre-validation is already done. Income-tax refund will be issued in the pre-validated bank account only.

Remember if PAN is not linked with Bank account and not pre-validated on the e-filing website no refund will be issued. One must take care of it while filing Income Tax Returns or ITRs henceforth. The same is equally important for earlier assessment year(s) if refund for those earlier assessment year(s) is yet to be received.

Conclusion

Thus it is now mandatory to link PAN and Bank account and also to prevalidate the bank account in order to avoid the refund failure due to PAN not linked to bank account. Also please note that to prevalidate a bank account on the income tax e-filing website, it is necessary that mobile number must be registered with the bank account.

Conclusion

Thus it is now mandatory to link PAN and Bank account and also to prevalidate the bank account in order to avoid the refund failure due to PAN not linked to bank account. Also please note that to prevalidate a bank account on the income tax e-filing website, it is necessary that mobile number must be registered with the bank account.

Get all latest content delivered straight to your inbox

Sociliaze with Us

9 Comments

My refund failed with the message PAN not linked, but my PAN is linked with the bank account selected for the refund. Also, that bank account was pre-validated too.

ReplyDeleteWhat should I do in this case?

Raise a refund reissue request. In many cases it is seen that the CPC has suo motto reissued the refund after some days.

DeleteThanks.

DeleteMy refund failed with the message that PAN is not linked to my Account, but my PAN is linked with the bank account. Also, that bank account was pre-validated. The Income Tax portal is not even allowing me to raise a refund reissue request, saying there is no refund failure. What should I do now?

ReplyDeleteI am also facing the same issue. Dont know what to do

DeleteMy refund from IT for ay 2021-22 &2022-23 failed mentioning pan-bank ifsc linkage failed but bank passbook shows pan no & bankIFSC .bank br also updated it still in thefailed a/c onprevalidating it what to do

ReplyDeleteSAME ISSUE

DeleteMy refund from IT for ay 2021-22 &2022-23 failed mentioning pan-bank ifsc linkage failed but bank passbook shows pan no & bankIFSC .bank br also updated it still in thefailed a/c onprevalidating it what to do

ReplyDeleteSame problem

ReplyDelete