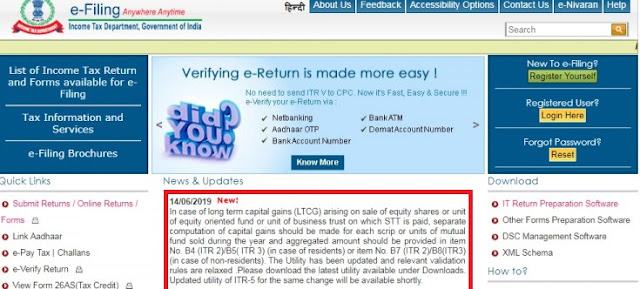

Recently on 14.06.2019 on the income tax e-filing website(https://www.incometaxindiaefiling.gov.in/home) a communication was flashed and it was stated that in case of long term capital gains (LTCG) arising on sale of equity shares or unit of equity oriented fund or unit of business trust on which STT is paid, separate computation of capital gains should be made for each scrip or units of mutual fund sold during the year and aggregated amount should be provided in item No. B4 (ITR 2)/B5( ITR 3) (in case of residents) or item No. B7 (ITR 2)/B8(ITR3)(in case of non-residents). The Utility has been updated and relevant validation rules are relaxed. Please download the latest utility available under Downloads. The updated utility of ITR-5 for the same change will be available shortly.

Edit: On 20/06/2019, the updated utility of ITR-5 notified on the e-filing portal.

The utility for ITR forms in ITR 1, 2, 3, 4, 5 & 7 for AY 2019-20 was made available on the income tax e-filing website on 04.06.2019 with the message that ITR 1, 2, 3, 4, 5 & 7 for AY 2019-20 is now available for e-Filing. ITR 6 will be available shortly.

Within 10 days the ITR 2 and ITR 3 were amended and a new version (PR1.2 for Excel utility and PR1.4 for Java utility) was released. An article was published on Economic Times (ET) which highlighted an error in the ITR filing software utility for reporting the Long Term Capital Gains or LTCG arising from the long term sale of equity shares or equity oriented mutual fund units.

Readers may be aware that the Budget 2018 had withdrawn the exemption available to long term capital gains arising from the sale of long term equity shares or units of an equity oriented mutual funds on which STT is paid. However, grandfathering was allowed in case such shares or units were purchased before 01.02.2018. In those cases, the gain derived till 31.01.2018 was made exempt from the date of acquisition of equity shares or units. The deemed Cost of Acquisition of such shares or units shall be higher of-

a) the actual cost of acquisition of such share or unit; or

b) the fair market value of such share or unit or actual sales consideration for its transfer, whichever is lower.

The Fair Market Value of a listed equity share shall be its highest price quoted on the stock exchange on 31st Jan. 2018. If shares are quoted on both NSE or BSE, then the price of anyone can be taken.

Thus, FY 2018-19 (or AY 2019-20) was the first year in which such LTCG will be taxable.

On a plain reading of the provision, it can be inferred that such Long Term Capital Gain (LTCG) or loss shall be computed for each share or unit separately.

The software utility released on 4th June required to disclose the long term capital gains on sale or transfer of shares or units in 2018-19 on a consolidated basis. The ET article stated that the ITR form allows only consolidated figures instead of reporting each transaction separately. Filing aggregate values could result in mistakes because, unlike other assets like real estate, gold and debt investments, calculating the LTCG on equity investments are slightly more complex due to the grandfathering clause.

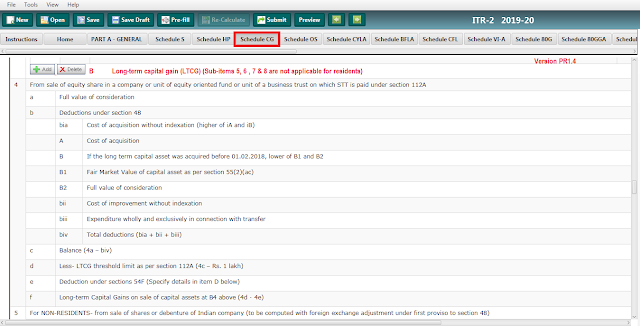

The ITR Form 2 released on 4th June (PR1.3 java based utility) required the reporting of LTCG from the sale of shares or units in the manner as shown in the picture below-

Now, look at the reporting of such long term capital gain or loss arising from erstwhile exempt shares or units in the ITR Form 2 released on 14th June (PR1.4 java based utility) -

Unfortunately, there is no update in the software or utility. The disclosure requirement for LTCG on shares or units is still the same. The above images are for Java-based ITR-2 utility relevant for AY 2019-20.

However, this expression of the communication on the e-filing portal "The Utility has been updated and relevant validation rules are relaxed. Please download the latest utility available under Downloads." gives the impression that the software is updated with the new requirement of showing the separate computation of capital gains for each scrip or units of mutual fund sold during the year. Further, the download section of the e-filing website shows new version PR 1.4 for Java utility and is dated as 14.06.2019. The communication of even date further fortifies the impression.

As can be seen from the above two images or screenshots, there is no change implemented in the new version PR1.4 for reporting separate computation of capital gains for each scrip or units of mutual fund sold during the year.

This has created confusion among the taxpayers. The 14th June communication and the updated utility on the even date are not corroborating. It is also not clarified whether a new version is on the way and taxpayers should wait for the new version corroborating with the communication and adhering to separate computation of such long term capital gains.

What if taxpayers file the ITR 2 with version PR 1.4 on and report the long term capital gain on transfer of shares or units on a consolidated basis.

Interestingly, when the java utility zip file is extracted on the local computer, the date of modification for the executable file of version PR1.4 (See the item named 'ITR-2_AY201920_PR1.4' in the below image) is showing as 13/06/2019 whereas the communication on the e-filing website is dated 14th June. This means the software was modified before the announcement was made but not in line of the announcement.

Those who earn such capital gains up to Rs 1,00,000 need not be worried since their gain is anyway exempt.

Though it is not clarified what will happen to those tax returns which were already filed before the release of new utility or Form and shown the LTCG on the sale of shares or units on a consolidated basis.

It is understood that those returns filed using version 1.3 or 1.4 cannot be considered as defective or invalid because these utilities are officially released. However, one is advised to keep the proper workings of the LTCG on individual share or unit basis.

It is understood that those returns filed using version 1.3 or 1.4 cannot be considered as defective or invalid because these utilities are officially released. However, one is advised to keep the proper workings of the LTCG on individual share or unit basis.

Instead of creating confusion among the taxpayer it would have been better had the department releases the software after proper testing and validation. It seems that no one learned any lesson from the faulty implementation of GST returns. Rather such pitfalls are now incorporated in the returns of income tax too.

Also Read:

What is the difference between Tax and Surcharge and Cess?

Banking Cash Transaction Tax for 2019

Tax on maturity proceeds from a Life Insurance Policy

Standard Deduction 2019 in Income Tax

Also Read:

What is the difference between Tax and Surcharge and Cess?

Banking Cash Transaction Tax for 2019

Tax on maturity proceeds from a Life Insurance Policy

Standard Deduction 2019 in Income Tax

Get all latest content delivered straight to your inbox

Sociliaze with Us

1 Comments

Can you kindly comment on how possibly one can report LTCG after taking into consideration Grandfathering clause in cases where there has been a merger of Gruh and Bandhan in ratio of 1000 shares of Gruh exchanged for 568 shares of Bandhan ? We bought Gruh shares in 2005, say 1000 shares. Now when we sell Bandhan shares (equivalent quantity awarded 568), when put the FMV (of Gruh ), shouldn't we get proportionate equivalence of multiple (1000/568) ? when full value of FMV is calculated in schedule 112A under present form, the quantity of shares sold (of Bandhan) will be multiplied by FMV of Gruh giving erroneous picture of total FMV value ! Your response would be gratifying. Thank you

ReplyDelete