By an Order u/s 119 dated 14.05.2019 issued vide Circular No. 9/2019 extended the date for reporting of GAAR and GST details in clause 30C and Clause 44 respectively in the Tax Audit Report in Form 3CD till March 2020.

This means, like the preceding year, no details for General Anti-Avoidance Rules (GAAR) and GST in the Tax Audit Report for FY 2018-19 is required to be given. This has brought a big relief to the assessees covered by tax-audit provisions and tax-auditors as well since it will put additional burden on the assessees to maintain separate details and accounting which is otherwise not required under GST law.

It is pertinent to note that the Board has amended the Form 3CD in July 2018 vide Notification 33/2018 dated 20.07.2018 with effect from 20.08.2018. However, on 17.08.2018, the Board had issued a Circular No. 6/2018 and deferred the applicability of clause 30C (pertaining to GAAR) and clause 44 (pertaining to GST) till 31st March 2019.

This is for the second time the Board has deferred the reporting requirement of the said clauses till March 2020. The reasons for the deferment is same for both the years and because of representations received from stakeholders that the implementation of the reporting requirement under clause 30C and 44 of the Form 3CD may be deferred, the board has extended the compliance date.

Also read:

CBDT Circular for quoting of Aadhaar number in ITR

CBDT Notification for linking PAN with Aadhaar

No tax on Income up to Rs. 5 Lakh as per Interim Budget 2019

Why the government has extended the linking of PAN and Aadhaar number from 31.03.2019 to 30.09.2019?

The details of reporting requirements under Clause 30C pertaining to GAAR, which is now extended till March 2020, is given below-

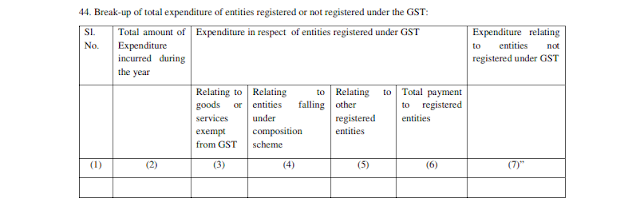

The details of reporting requirements under Clause 44 pertaining to GST, which is kept in abeyance till March 2020, is given below-

Companies or other business entities having a turnover of more than Rs 1 crore (or Rs 2 crore if they have opted for presumptive taxation) and professionals with gross receipts of more than Rs 50 lakh during a previous year or financial year have to comply with the tax audit requirements.

Download CBDT Circular No. 9/2019 dated 14.05.2019

Download CBDT Circular No. 6/2018 dated 17.08.2018

Download CBDT Notification No. 33/2018 dated 20.07.2018

Download CBDT Circular No. 6/2018 dated 17.08.2018

Download CBDT Notification No. 33/2018 dated 20.07.2018

Get all latest content delivered straight to your inbox

Sociliaze with Us

0 Comments